Donor Advised Funds: Are You Ready For Change?

Donor Advised Funds are about to have a big coming-out party. Donor-advised funds (DAFs as they are commonly called) are the vehicle of choice for wealthy individuals. DAFs are useful alternatives to private foundations and make it easy to give money to a charity at a time of their choosing while claiming immediate income tax deductions.

Donor Advised Funds For the Wealthy

Donor Advised Funds started becoming popular in the early 90s. Until recently, Donor-Advised Funds were only available to wealthy individuals who had private wealth or brokerage accounts. Some of the classic Donor Advised Funds are run by Fidelity, Vanguard, and the Jewish Communal Fund.

Typically a minimum contribution of $25,000 or more was required to open a DAF. As a result, 99% of American households have been unable to access Donor Advised Funds or their significant advantages for charitable giving.

Donor Advised Funds For The Millenial Era

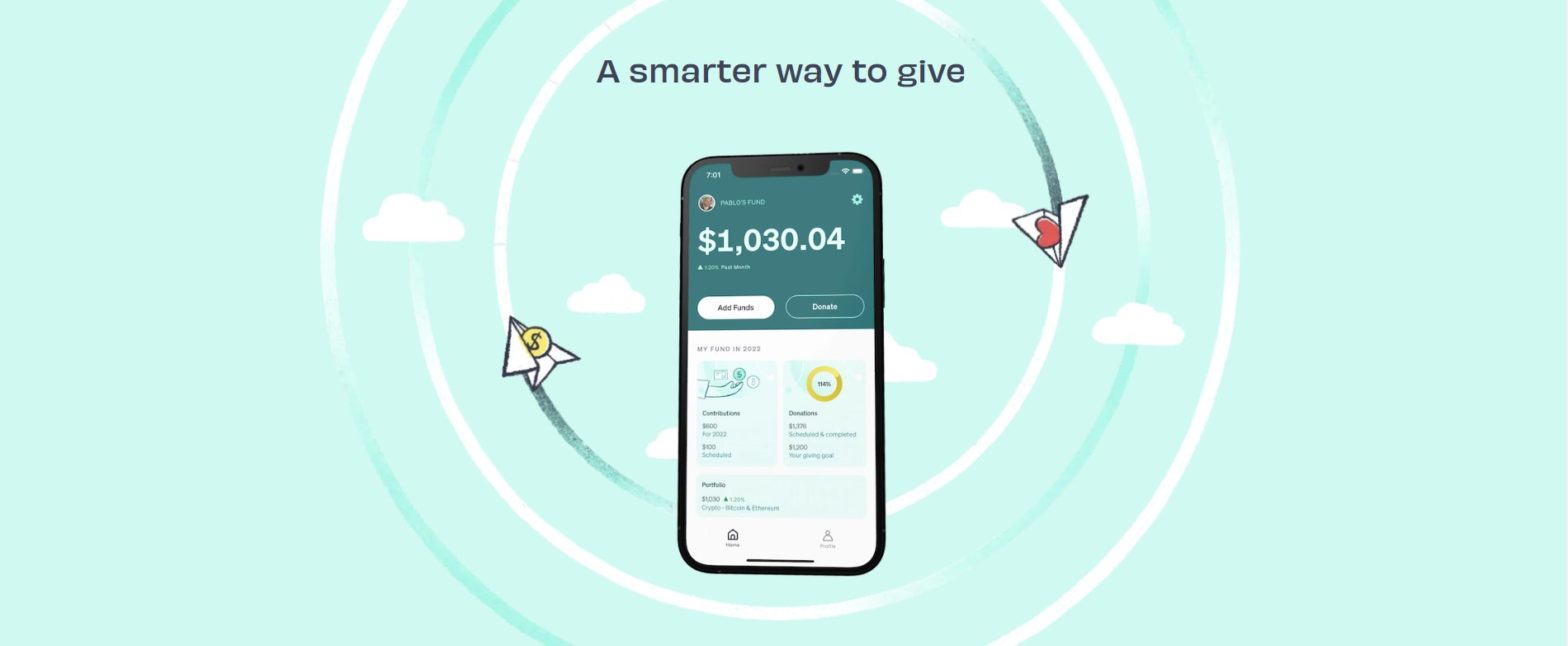

Today, many companies are offering low-cost DAFs with superior, more modern, and mobile-first technology platforms. For this reason, expect gifts via DAF to increase dramatically over the next few years. You will start to see DAF contributions in campaigns like sustained giving programs, Giving Tuesday campaigns, Peer-to-peer events and more.

What this Means For Your Organization

You must be prepared to accept donations from Donor Advised Funds. In addition, It is important to make your donors aware of how easy it is to set up a DAF and how they can benefit from doing so.

- 501 (c) 3 status

Make Sure Your Organization has 501(c)3 status. Most platforms will not distribute donations to an organization that does not have this status even if they are a registered nonprofit organization. - Give DAFs an equal opportunity

When you offer your donors to donate with a check, credit card and Google Pay, make sure that you add donor-advised funds as an option as well. - Integrate DAFs into your donation forms

Make sure your donation form allows for people to pay through their Donor Advised Fund. (see tools below). This makes it as easy to donate via DAF as it is with a credit card. - Educate Your mid-tier donors

Most of your major donors will be familiar with a donor-advised fund, but your mid-tier donors may not. Be a resource to your mid-level donors and explain the benefits of setting up a DAF. They will thank you for the help and your organization may be first on their list of charities to give to. - Mention DAFs in all donor communications

Constantly remind your donors in letters, emails, newsletters, and conversations about how easy it is to give a gift via a donor-advised fund.

New Donor Advised Fund Platforms and Tools

In the last few months, several new DAF platforms and startups have surfaced. Here are a few that you should know about

Groundswell

Groundswell democratizes philanthropic giving. They make charity an employee benefit that gives users the power of a personal foundation in the palm of their hand. With Groundswell a company can allow their employees to set up a DAF and have their contributions matched by their employers.

Chariot

Launching soon, Chariot is a payment button that nonprofits can add to their donation form enabling donors to give with their DAF. Chariot is in the process of building out integrations with all 976 Donor Advised Funds, from community foundations to commercial providers, enabling all DAF donors to give in a few simple steps.

Paypal

PayPal recently launched Grant Payments, The new product has been created in partnership with National Philanthropic Trust (NPT) and Vanguard Charitable and allows Donor-Advised Fund (DAF) sponsors, community foundations and other grantmakers to move their donations electronically through PayPal’s platform.

Daffy

With Daffy you choose how much you want to give one-time, weekly, or monthly—and they automate the rest. Donate any amount and Daffy only charges $3 a month!

The Donors’ Fund

The Donors’ Fund offers many features that make it amazingly easy to give. They provide a bank-like account portal, mobile app, and giving cards and don’t require your nonprofit to be a 501(c)3

Charity Vest

Charity Vest provides a world-class giving experience without big fees & minimums. The basic plan is completely fee-free.

Looking for more fundraising resources? Visit charity.studio/resources

Looking to fundraise fast? Check out PhoneRaise.com

Author:

Tzvi Schectman

Date:

September 12, 2022

Tags:

Fundraising

Enjoying what

you've read?

Here's more.

8 Fundraising Trends from the 2022 Bridge Conference

Tzvi Schectman

Last week I spent two days at the Bridge to Integrated Marketing & Fundraising Conference (yep it’s...