7 Great Expense Tools to Manage your Organization’s Spending

Your organization needs money to cover the cost of your facility and to cover payroll. Your staff needs money to pay for program items, occasional travel, and other expenses. As your organization grows so do your expenses. You start wondering how come so much money is being spent, your staff are wondering why it takes so long to get reimbursed. Both of you are wondering what is the expense budget for programs?

Its time for a little technology to help everyone in your organization manage expenses, stay within their budgets, set expectations and communicate. These seven tools can help!

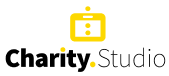

1. Divvy

Divvy is a free fully-automated platform that manages organization expenses and places budgets at the point of purchase. With Divvy, employers can give employees direct access to funds, effectively eliminating expense reports and retroactive reimbursement.

After signing up, the organization owner and their designated employees receive physical Divvy cards. Divvy cardholders can create secure online (virtual) cards, set spending and budget controls, and control card activity in Divvy.

Divvy lets you easily set up budgets to manage all of your spending. Budgets can be set by teams, projects, events, or any other way you want to track your spending. You can set up your budget on a recurring or one-time basis. The same goes for sending money to members of your team.

Website: getdivvy.com

Pricing: Free

Integrations: Quickbooks

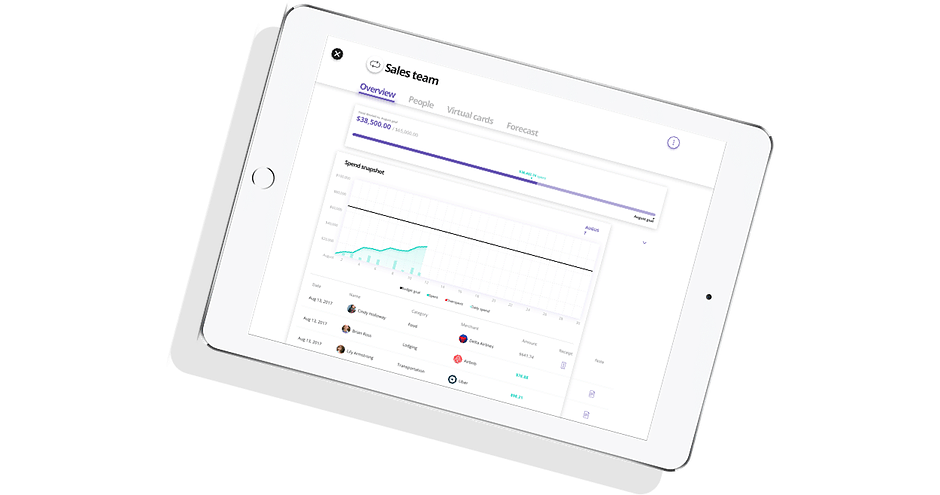

2. Abacus

Abacus is the easiest way for you to automate how you reimburse your team, reconcile corporate credit cards, and implement your expense policy.

Capture accurate expense data from employees

Abacus drafts expenses using reliable data sources such as receipts and card transactions to ensure records are complete and accurate.

Expense Policy

Automate your expense policy and approval hierarchy Policy rules are applied before expenses are submitted to prevent violations. Routing rules then automatically send the expense to the best matched approver.

Strategic Insights

Instant visibility into spending and budgets Build custom reports with real time data to help you identify trends and manage budgets.

Website: abacus.com

Pricing: Free

Integrations:

- Quickbooks

- Xero

- Salesforce

- Slack

- Zapier

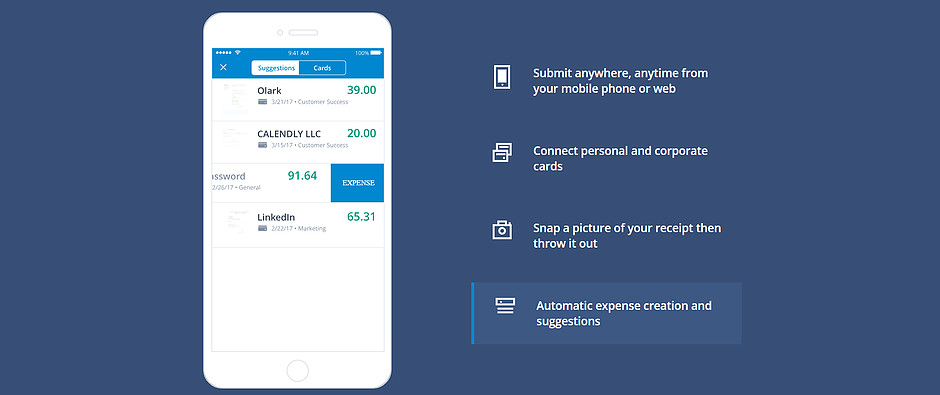

3. Fyle

Fyle is great for seamless management of expenses. It uses Artificial Intelligence to create automated policy checks and custom approval hierarchies, you can focus on being productive instead of chasing staff for expense reports.

Some of the features Fyle offers are:

Receipt management

Access your receipts from anywhere, anytime. Fyle also provides An industry-first data extraction engine which collects expense data from your paper and e-receipts automatically.

Approval automation

Automatic approval for expenses compliant with your expense policies with multi-level approvals.

Digital audit trail

A comprehensive digital trial for all expenses and reports with detailed logs made on an expense.

Credit card reconciliation

Reconcile corporate credit card statements with expenses and sync with your accounting software.

Email Plugins

Report expenses right from your Outlook or Gmail inbox.

Mobile apps for reporting

Track and report expenses from your mobile without ever having to do manual expense entry

Website: fylehq.com

Pricing: $19 per month for up to five users paid annually

Integrations:

- Quickbooks Online

- Zapier

- Gmail

- Outlook

4. Fetch

*Note: Fetch is still in beta mode

Fetch is a simple, straightforward and easy to use app that helps manage expenses and track spending in categories. They use a simple 6 step process

1. Enroll Your Team

Everyone on the team will get an email with a link to download the free iOS or Android app. Once they download it, they’re in! No logins or passwords and they can start submitting expenses right away.

2. Teams submit expenses via photo or email

For paper receipts, they just open Fetch, snap a photo, choose an expense category and whether it’s reimbursable – and submit. For digital receipts, it works exactly the same way except instead of snapping a photo they simply forward the receipts to receipts@fetchmoney.com.

Manage Expenses

The simple and powerful Fetch dashboard lets you view, approve and pay expenses in one place. You can also message team members directly through the app for any clarifications. View expenses with corresponding receipt images at any time and send out reminders to those team members who are late with their submissions.

Run Reports

Get a complete understanding of organization expenses by running customizable CSV and PDF reports.

Pay Expenses

Fetch makes reimbursing expenses a breeze with ACH deposits.

One click, and money is on the way to employees who are notified as soon as it is sent and deposited. No more wondering when they are getting paid back!

Sync with your Accounting Systems

Sync Fetch with QuickBooks Online and get all your finances in one place, hassle free.

Each time an employee is reimbursed, a new entry is automatically sent to QuickBooks Online. No extra clicks, no annoying export screens, just peace of mind.

Website: fetchmoney.com

Pricing: $9.95 per user, admins are free

Integrations: Quickbooks Online

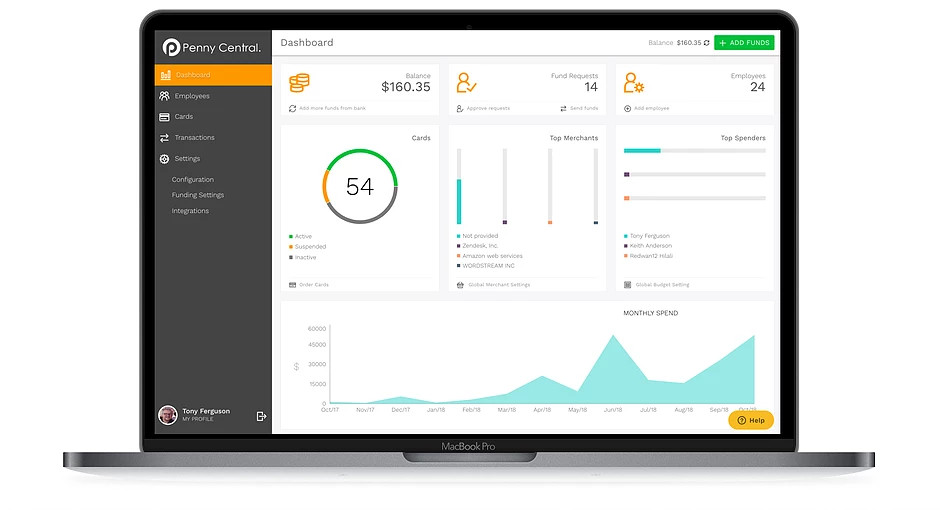

5. Penny inc

Penny Inc is a great way to control and monitor your organization expenses.

It’s a complete solution that removes manual data entry and time-consuming reimbursement processes, forever.

Fast and easy set-up

Online registration takes less than ten minutes, and Penny MasterCard Debit cards are delivered within seven days.

Control your organization expenses

Track transactions in real-time to oversee where and how each Penny card is used. Restrict merchants and/or set daily spending limits on employee cards.

Request funds on the go

Paired with a mobile application, employees can request funds, make payments, and check their fund balances. You can approve fund requests from anywhere, anytime, to instantly transfer funds to Penny cards.

Expense tracking reminders

Penny Inc’s mobile app prompts the purchaser to photograph the receipt at the time of purchase and attaches it to the transaction, instantly stored for the organization administrator to access.

Alignment with accounting software

Transactional data made on Penny cards can be exported to various accounting programs, or seamlessly integrated to Quickbooks via a real-time sync.

No maintenance or usage fees

The Penny Inc desktop application, cardholder app and prepaid debit MasterCards and virtual cards are all free.

Website: thepennyinc.com

Pricing: Free

Integrations: Quickbooks Online

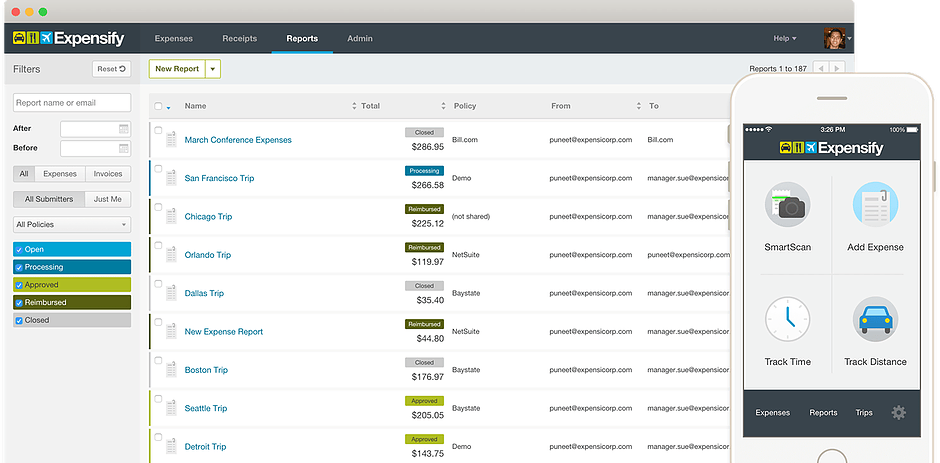

6. Expensify

Expensify automates the entire receipt and expense management process. Stop sifting through piles of reports. Configure Expensify to flag the receipts that need human attention and automatically approve and reimburse everything else. With multi-level approval workflows, Expensify gives you complete control and visibility over organization finances.

One-Click Receipt Scanning

Expense management made easy. Take a picture of your receipt and Expensify automatically submits an expense report for you in just one click!

Next-Day Reimbursement

As soon as reports are approved, rapid reimbursement delivers the money right into the employee’s bank account within 24 hours via ACH direct deposit.

Automatic Approval Workflows

Admins can customize expense policy rules for their organization and configure Expensify to flag any expenses that actually need a manager’s review. The rest — like that $3 coffee receipt — are automatically approved.

Automatic Accounting Sync

Any changes made in your accounting system are automatically synced with Expensify in real-time for constant visibility into your organization’s finances, making audits and tax season a breeze.

Website: expensify.com

Pricing: Free – $9 per user per month

Integrations:

- Quickbooks Online/Desktop

- bill.com

- Uber

- Lyft

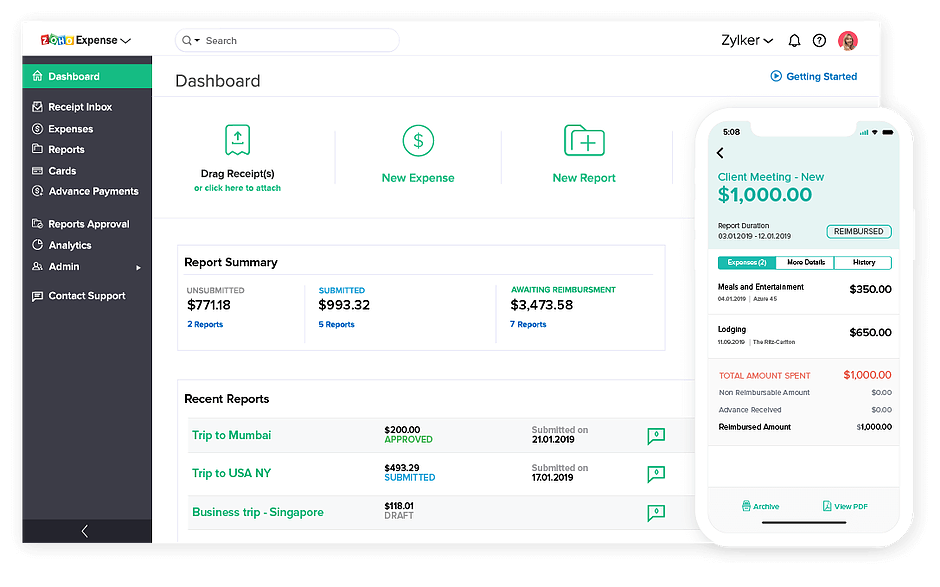

7. Zoho Expense

Zoho Expense is online expense reporting software, tailor-made for organizations to automate expense report creation, streamline approvals and make swift reimbursements. Here are some of the features of Zoho Expense

Auto-scan your receipts

Just photograph a receipt, and Zoho Expense automatically saves the important details like the date, cost, and organization name. Forward the receipts in your inbox to Zoho Expense, and Email Receipts will scan them for easy expense reporting.

Add expenses easily

Record expenses as they happen. Attach a receipt, enter the cost, and pin the expense to a report. You can sort expenses by category, write notes, and add additional entry fields.

Map debit and credit cards

Automate debit, credit, or corporate card and bank statement importing by adding your cards in Zoho Expense. Take card transactions and convert them into expenses with the click of a button. Avoid double entry and duplicate expenses.

Keep a check on expenses

Define rules for your employees’ expense reports. Set up spending limits, expiration periods, mileage rates, and more.

Customize your reporting

Customize your expense reporting preferences by adding custom fields to reports. Set up notifications when submitting and receiving expense reports for approval.

Create approval flows

Create custom approval flows for every employee or department. Criteria-based approval lets you create unique approval flows for your expense reports.

Website: zoho.com/expense

Pricing: Free – $2.50 per user per month

Integrations:

- Most Zoho Products

- Quickbooks Online/Desktop

- Slack

- Uber

- Lyft

- Dropbox

- Google Drive

Have a great expense tool that you use? Tell us about it!

Author:

Tzvi Schectman

Date:

February 3, 2019

Tags:

Organizational Management, Tools

Enjoying what

you've read?

Here's more.

Event Management Apps: A Guide To Help You Decide

Tzvi Schectman

Do you look back 25 years and fondly remember an era of simpler times? An era when registration was done...